In the fast-paced world of automated trading, where algorithms execute split-second decisions, the stakes are incredibly high. Investors often focus heavily on maximizing profits, but overlooking risk management can lead to catastrophic losses.

Integrating risk management into your automated trading strategy isn’t merely a precaution; its an essential framework that safeguards your investments against unpredictable market movements. From setting concrete stop-loss levels to employing advanced techniques like diversification and position sizing, effectively managing risk ensures that your automated systems operate not just efficiently, but also safely.

In this article, we will explore practical approaches to embed risk management in your trading algorithms, helping you navigate the complexities of the market while safeguarding your capital. Buckle up, as we delve into this critical aspect of trading that separates the savvy investor from the reckless gambler.

Introduction to Automated Trading and Risk Management

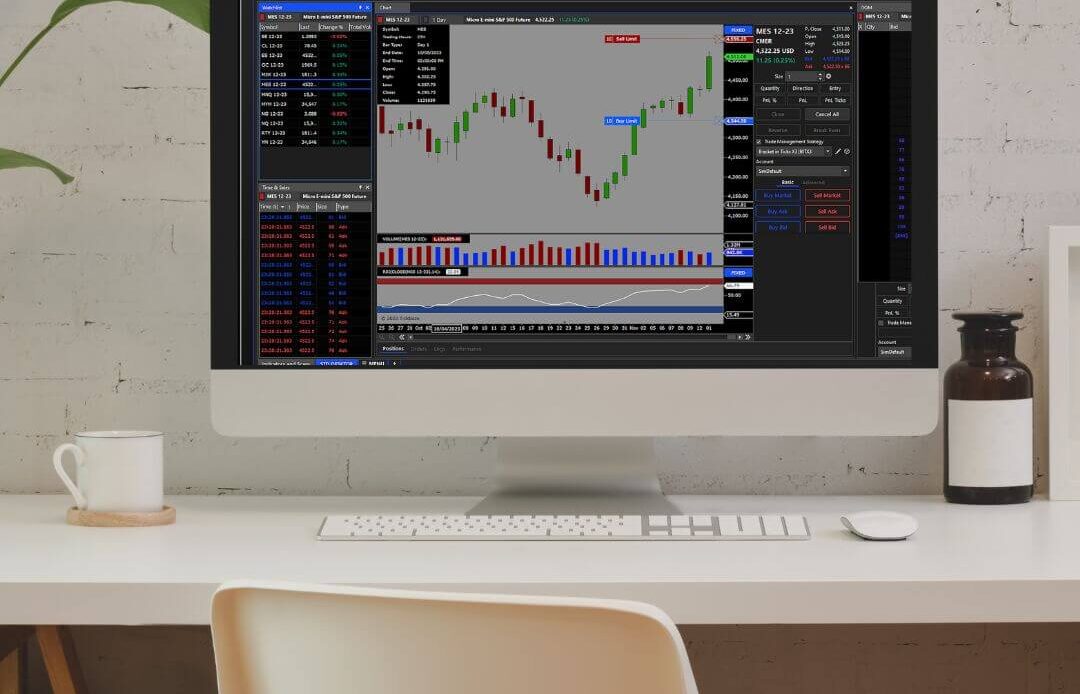

In the realm of financial markets, the fusion of automated trading with sophisticated risk management strategies, such as those found with automated trading platform, represents a transformative paradigm. Automated trading, characterized by algorithms that execute buy and sell orders at lightning speed, brings forth the promise of efficiency and precision.

However, beneath this technological veneer lies the necessity to navigate potential pitfalls that can arise from market volatility and unexpected events. Herein lies the critical role of risk management: it encompasses a range of techniques that shield traders from excessive losses while optimizing their return potential.

By understanding the interplay between automation and risk, traders can harness data-driven insights to refine their strategies, adapt to ever-changing market conditions, and ultimately enhance their resilience in the face of uncertainty. Embracing this integration is not just a matter of enhancing profitability; it is about cultivating a sustainable approach to trading in a landscape where unpredictability is the only constant.

Defining Risk Management in Trading

Risk management in trading serves as the backbone of a sustainable strategy, functioning as the essential framework that mitigates potential losses while maximizing gains. At its core, risk management encompasses a series of techniques and rules designed to protect capital and ensure longevity in the turbulent sea of financial markets.

Traders must first identify the various types of risks they face—market risk, liquidity risk, credit risk, and operational risk, to name a few. By meticulously employing tools such as stop-loss orders, position sizing, and diversification, traders can create a buffer against unforeseen market fluctuations.

However, risk management isnt merely about preventing losses; its about fostering a disciplined mindset—one that embraces calculated risks and aligns with an overarching trading philosophy. Navigating through the complexities of the market requires not just intuition but an intelligent approach to balance risk and reward, ultimately shaping a trader’s journey towards consistent profitability.

Continuous Monitoring and Adjustment of Risk Strategies

Continuous monitoring and adjustment of risk strategies is vital for the dynamic landscape of automated trading. Market conditions are not static; they shift with the tide of news, economic indicators, and trader behavior, creating a mosaic of opportunity and risk.

As your algorithms churn through data, maintain a keen eye on performance metrics and risk exposure, recalibrating your strategies with the agility of a seasoned sailor adjusting sails in changing winds. It’s essential to leverage real-time analytics to identify potential anomalies or market shifts, which could signify a need for an immediate pivot in your approach.

Moreover, fostering a culture of consistent review—where historical data informs future strategies—ensures that your system evolves rather than stagnates. Harnessing advanced machine learning techniques can further enhance your ability to detect patterns and adjust parameters on-the-fly, allowing your trading strategy to not just react but anticipate the rhythm of the markets.

This proactive stance can be the difference between seizing opportunities and falling prey to unforeseen pitfalls.

Conclusion

In conclusion, effectively integrating risk management into your automated trading strategy is paramount for achieving long-term success in the financial markets. By employing robust risk assessment tools, setting clear stop-loss orders, and regularly reviewing your performance metrics, you can significantly mitigate potential losses while maximizing returns.

Leveraging an automated trading platform not only streamlines this process but also allows for real-time data analysis and adjustments to your strategy based on market conditions. Ultimately, by prioritizing risk management, traders can navigate the complexities of automated trading with greater confidence and resilience, paving the way for a more sustainable and profitable trading journey.